The 9-Second Trick For Personal Loan

Wiki Article

Fascination About Mortgage

Table of ContentsA Biased View of Payday LoansThe 9-Second Trick For Loans For Bad CreditLoans For Bad Credit Can Be Fun For EveryoneAn Unbiased View of Mortgage RatesMore About Mortgage Rates

Community Service Our company believe in returning to our neighborhoods by supporting local companies and contributing our time as well as talents. We even offer partners a paid day of rest annually to volunteer with a source of their selection.0035 times your financing amount (or simply over $35 for a $10,000 funding), will certainly be included to your funding quantity if your funding demand is approved and also moneyed. Stamp tax obligation is NOT included when identifying lending interest rate. Once approved, e-sign your lending agreement and set-up your car loan for funding.

A minimum of 25% of approved applicants looking for the most affordable price qualified for the most affordable rate available based upon data from 10/01/2021 to 12/31/2021. Price is priced estimate with Vehicle, Pay discount. Car, Pay discount is just readily available prior to car loan funding. Rates without Vehicle, Pay are 0. 50% factors greater.

The 6-Second Trick For Loans For Bad Credit

Optimum APR for a Light, Stream loan is. 1 You can money your finance today if today is a banking service day, your application is approved, and you complete the adhering to steps by 2:30 p.We delight in to introduce that we have become part of an agreement to acquire People's United Financial, Inc. "In Individuals's United, we have located a companion with a just as lengthy history of offering as well as supporting consumers, services and also communities," claimed Ren Jones, chairman as well as president of M&T Financial institution Firm, who will lead the mixed firm in the very same capacity.

A lending can aid you spend for things require when you don't have the money, yet obtaining money can be complicated. Starting the small business loan application procedure without understanding the ins and outs can create your funding demand to be turned down. Discover what to expect as well as what you can do beforehand to increase the odds of obtaining accepted.

Mortgage Can Be Fun For Anyone

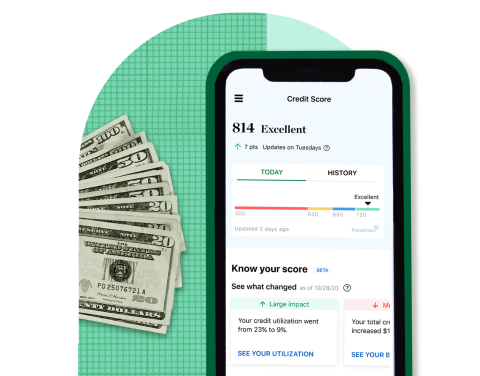

Once you establish a strong credit score background, loan providers will certainly provide you moreand at lower passion prices. Review your credit score background to see what lending institutions will see when you ask for a lending.This implies you may require to build credit report before you obtain a lending by gradually adding car loans to your history. Be certain to fix any blunders in your debt documents, as they make you a dangerous customer in the eyes of lending institutions and also injure your chances of getting an excellent lending.

If you don't make loan payments on time, your credit history rating could drop. Also factor in what your normal funding repayments might be as well as whether you can keep up with them according to the car loan settlement duration, be it monthly or quarterly.

That enables you to see just how much you'll spend for a loan of a specific quantity, and also exactly how a various car loan amount (or finance term, or rate of interest) might save you cash. There are lots of online tools out there to help you compute fundings. Obviously, car loan rates as well as useful link lender terms can make your final loan installments slightly different.

Current Mortgage Rates Things To Know Before You Buy

Understand the Finance Before you obtain a financial institution car loan, take a look at exactly how the financing jobs. Do you have to settle a certain means (perhaps the lender requires you to pay digitally with your bank account)?

Get a car loan that you can actually handleone that you can pleasantly settle which won't prevent you from doing other important things (like conserving for retired life or having a little fun). Identify just how much of your revenue will certainly go towards finance repaymentlenders call this a financial debt to revenue proportionas well as borrow less cash if you do not like what you see.

The Ultimate Guide To Loans

When loading out an application, you'll supply information regarding yourself and also your financial resources. You'll need to bring identification, supply an address as well as social safety and security number (or comparable), and supply information regarding your income - mortgage rates today. Prior to you apply, make sure you can provide evidence of a constant income to enhance your probabilities of being authorized for an individual loan.Throughout underwriting, lenders will pull your credit (or just use a credit history) and assess your application. They might call you occasionally as well as ask you to clarify or confirm something. Make certain to follow these demands in a timely fashion to prevent lengthening the car loan application process. Organization Loans Organization car loans are comparable to any various other sort of financial institution funding.

Nevertheless, brand-new businesses do not have a long loaning background (or credit report). New enterprises visit this page and service companies usually do not very own properties that can be promised as security, so they have to work a little harder to get financings. Lenders typically look at the consumer's personal credit report as well as income to figure out whether they receive a business financing.

Company owner who do not have adequate organization credit might likewise have to pledge individual properties as security to obtain fundings. This is usually the only way to obtain financings in the very early years, however you need to try to build service credit rating so you can at some point obtain without risking individual assets.

Report this wiki page